Calculating Levered Free Cash Flow: Key Metrics and Formulas

Have you ever wondered how companies calculate their levered free cash flow? In this article, we will dive deep into the world of financial analysis and explore the key metrics and formulas used to calculate levered free cash flow. But before we get into the nitty-gritty details, let’s start with a simple question: What is levered free cash flow?

Have you ever wondered how companies calculate their levered free cash flow? In this article, we will dive deep into the world of financial analysis and explore the key metrics and formulas used to calculate levered free cash flow. But before we get into the nitty-gritty details, let’s start with a simple question: What is levered free cash flow?

Understanding Levered Free Cash Flow

Levered free cash flow is a financial metric that measures the cash a company generates after accounting for its debt obligations. It is a critical indicator of a company’s financial health and its ability to generate cash to meet its obligations.

The Formula

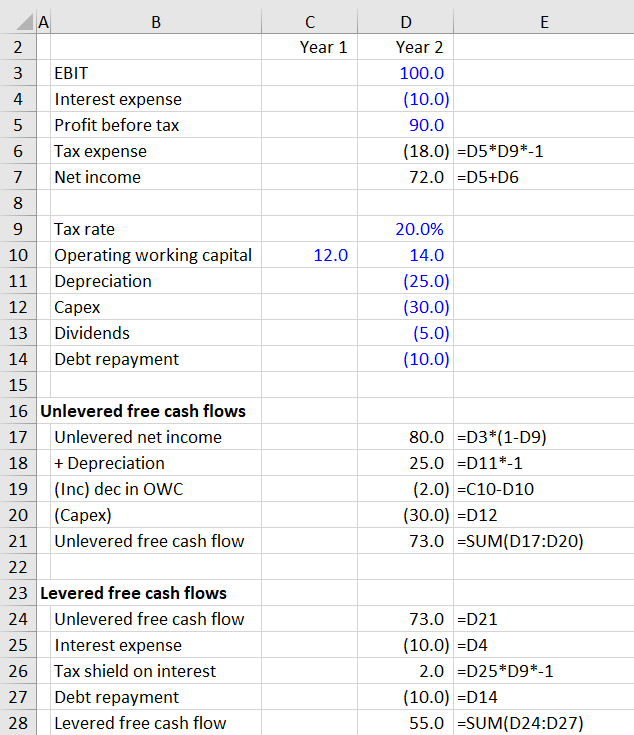

The formula to calculate levered free cash flow is as follows:

Levered Free Cash Flow = Operating Cash Flow – Capital Expenditures – Interest Expense + Taxes

Let’s break down the components of this formula:

- Operating Cash Flow: This represents the cash generated by a company’s core operations. It includes revenue, expenses, and changes in working capital.

- Capital Expenditures: This refers to the money spent on acquiring or upgrading assets such as machinery, equipment, or property.

- Interest Expense: This is the cost of borrowing money, such as interest paid on loans or bonds.

- Taxes: This represents the company’s tax obligations.

By subtracting capital expenditures, interest expense, and taxes from operating cash flow, we arrive at the levered free cash flow figure.

Importance of Levered Free Cash Flow

Levered free cash flow is an essential metric for investors and analysts as it provides insights into a company’s ability to generate cash and repay its debt. It helps evaluate the company’s financial performance and determine its value.

Conclusion

In conclusion, levered free cash flow is a crucial metric in financial analysis. It helps evaluate a company’s financial health and its ability to generate cash. By understanding the formula and key metrics used to calculate levered free cash flow, investors and analysts can make informed decisions about investment opportunities.